AI Analysis Comparison and Results Our evaluation process included testing multiple AI analysis approaches to determine the most effective solution for our financial data assessment. Initial analysis using a cost-optimized AI model produced results that did not meet our standards for investor presentation or internal decision-making. Subsequently, we engaged advanced AI-CFO capabilities that delivered professional-grade analysis suitable for investment banking discussions. This comparison demonstrates the importance of selecting appropriate AI tools for critical financial analysis, where accuracy and presentation quality directly impact stakeholder confidence and transaction success.

Initial AI Analysis - Insufficient Quality

This initial analysis lacks the precision and professional presentation standards required for investment banking discussions. The output quality is insufficient for stakeholder presentations and does not provide the analytical depth necessary for informed decision-making.

Professional AI-CFO Analysis - Investment Grade

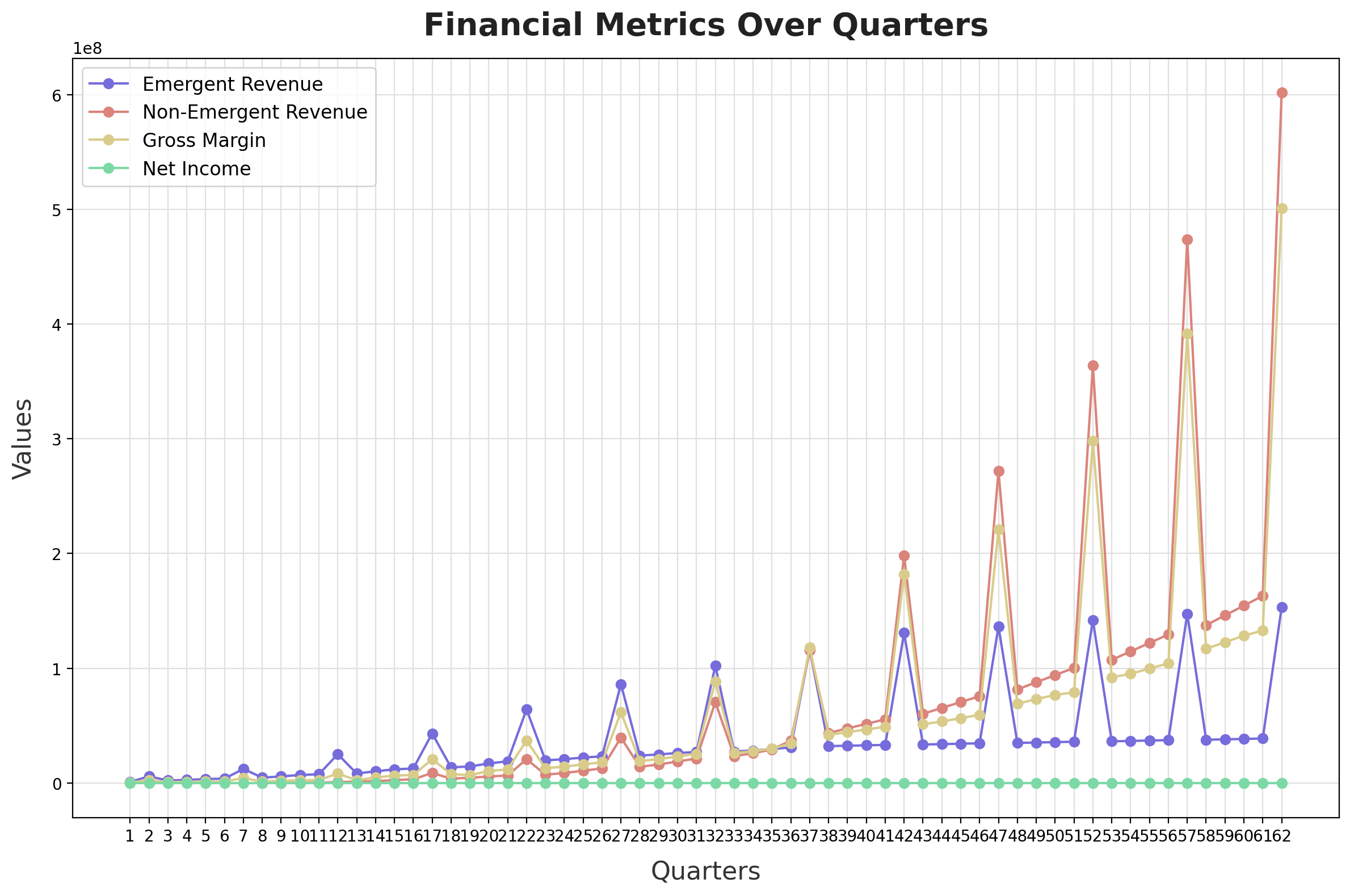

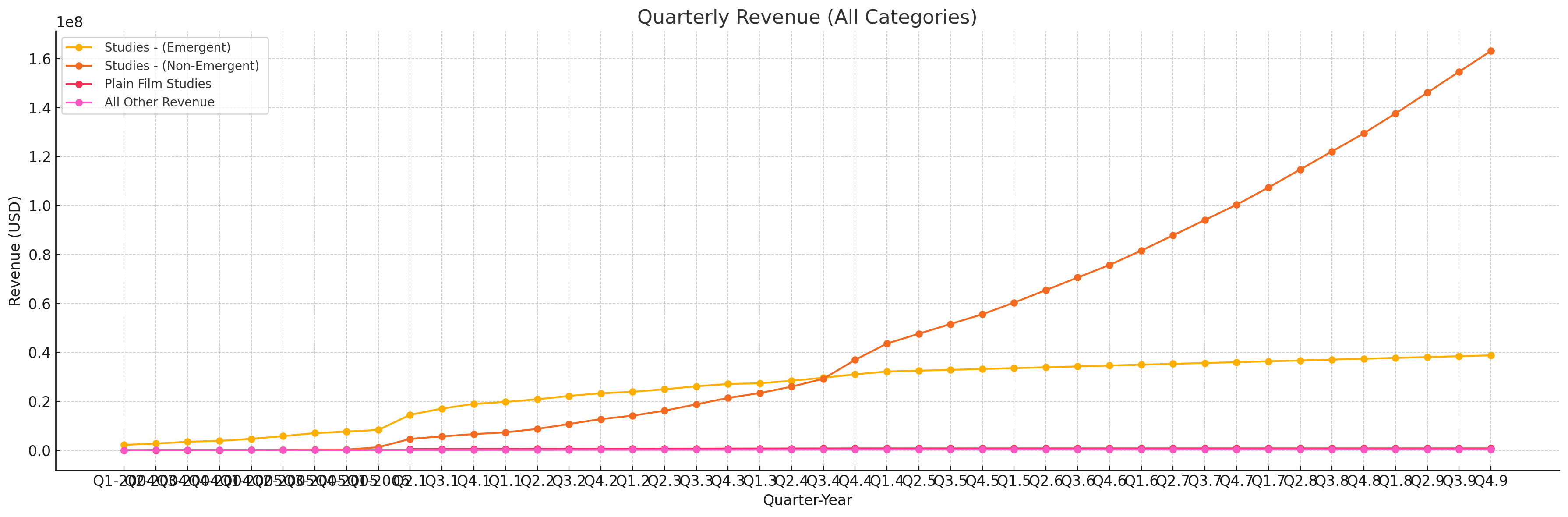

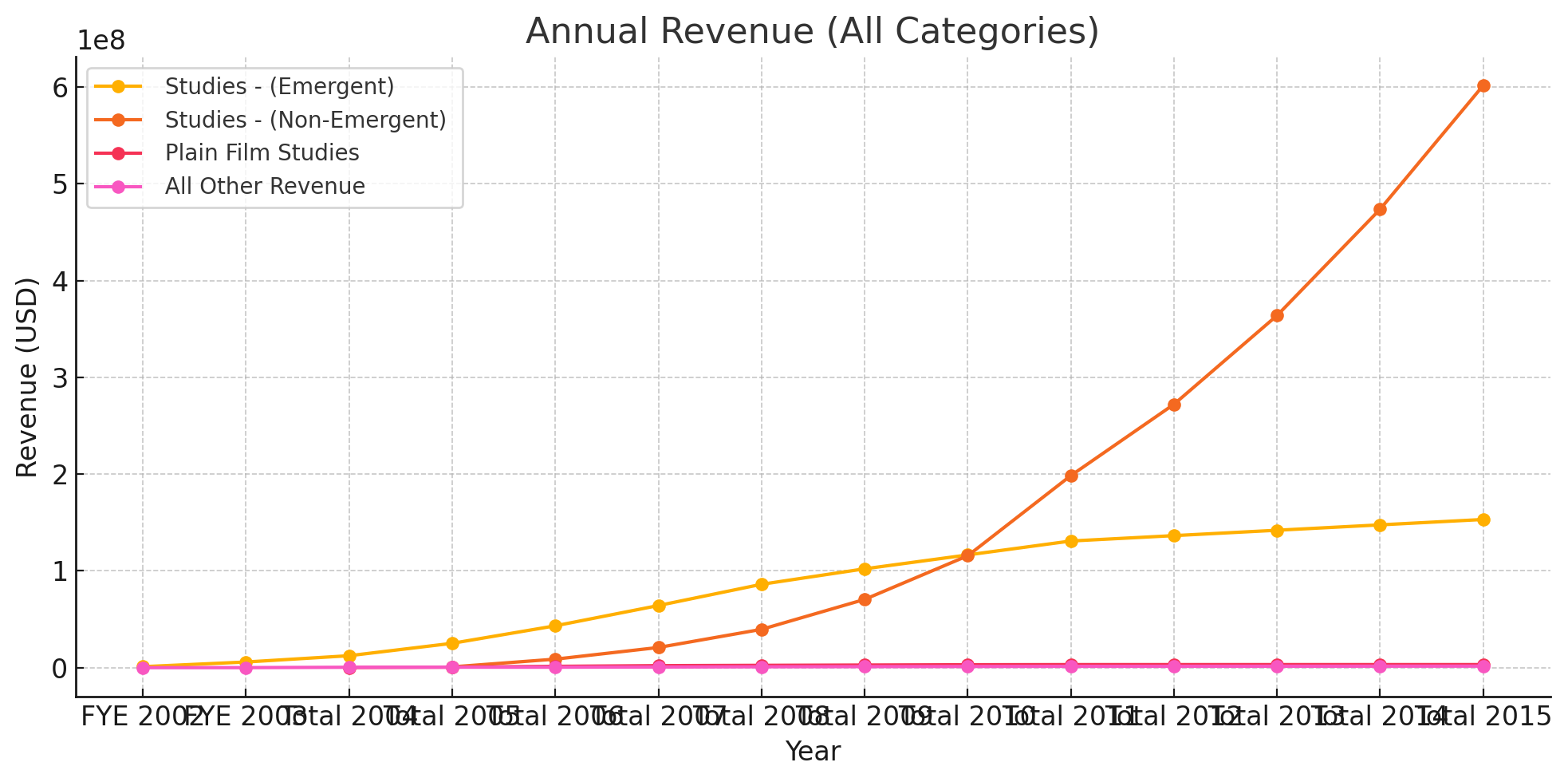

The advanced AI-CFO analysis delivers the comprehensive financial insights required for our IPO preparation:

Quarterly Revenue Analysis: This comprehensive quarterly breakdown demonstrates consistent growth patterns and seasonal trends that support our IPO valuation thesis. The analysis provides the granular detail required for investor due diligence.

Annual Revenue Projections: This long-term financial model showcases our growth trajectory and market expansion strategy. The projections align with industry benchmarks and provide a solid foundation for IPO pricing discussions.